-

Credit Repair Marketplace

-

Explore our extensive credit repair marketplace.

-

- Guaranteed Results

- Credit Insights

- For You?

People looking to learn how to consolidate credit cards immediately go to Google and search “how to consolidate my credit cards?”

It’s a reasonable thing to do, but there are some important things to consider when doing this.

The first thing you will find in Google is advertisements by those who sell the service of debt consolidation. It’s like a net being thrown. Whether you get caught in the net is based on whether you click through those ads.

Ads aren’t necessarily bad, though. Google does a good job of linking people selling things with people buying things. But for sure… you’re going to hire a particular product that may not solve your particular problem.

In that same Google search, you will see content below the ads. These authoritative websites write content about consolidating credit card debt. They likely are not offering a service to help you. They are simply writing about it.

This article falls between those two:

It always starts with a need or desire for a credit card or some other form of debt. If someone falls behind on the credit card payments, that debt can quickly spiral out of control.

Whether an individual was irresponsible, fell on hard times, or was taken advantage of by predatory lending practices, the need to consolidate debt remains.

So, let’s focus on solving the problem.

Every article I’ve seen on the topic jumps right and offers “solutions.”

There may be a larger issue, here. If you need to consolidate your credit card debt, this means something went wrong.

Everyone is different. Every situation is different. However, everyone should sincerely evaluate how the credit card debt grew to such an extent that consolidation became necessary.

In other words, don’t just consider how to consolidate credit card debt. You should also consider the root cause. Consider what you can do to either solve it or prevent it from happening in the future.

That’s more important than the consolidation, itself.

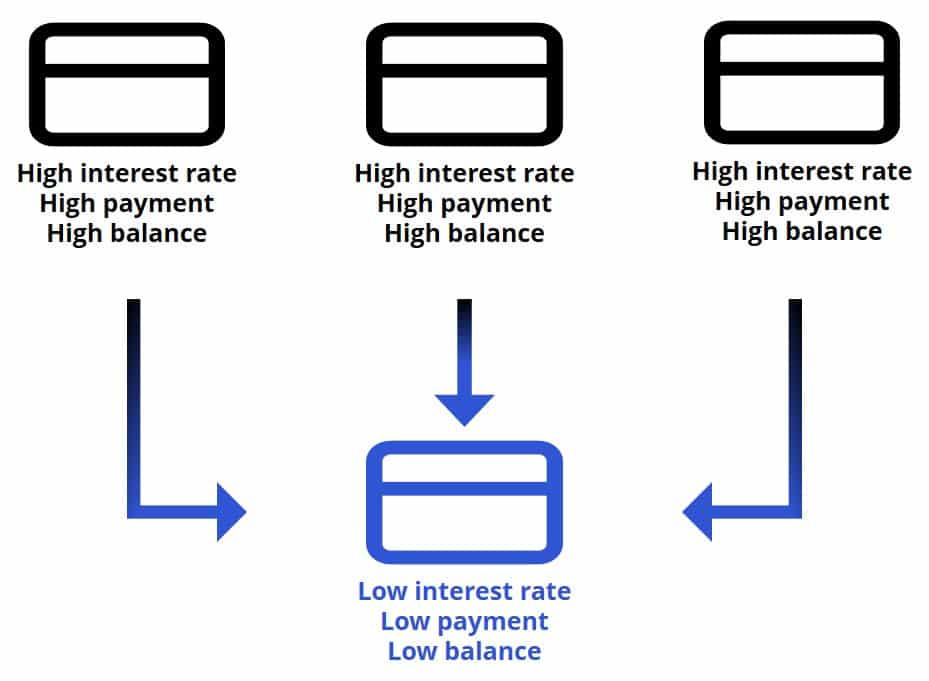

The first and most obvious way to consolidate debt is, ironically, to get more debt.

Seriously!

You can apply for a new credit card and transfer your balance from one card to the other. Why is this beneficial? You can:

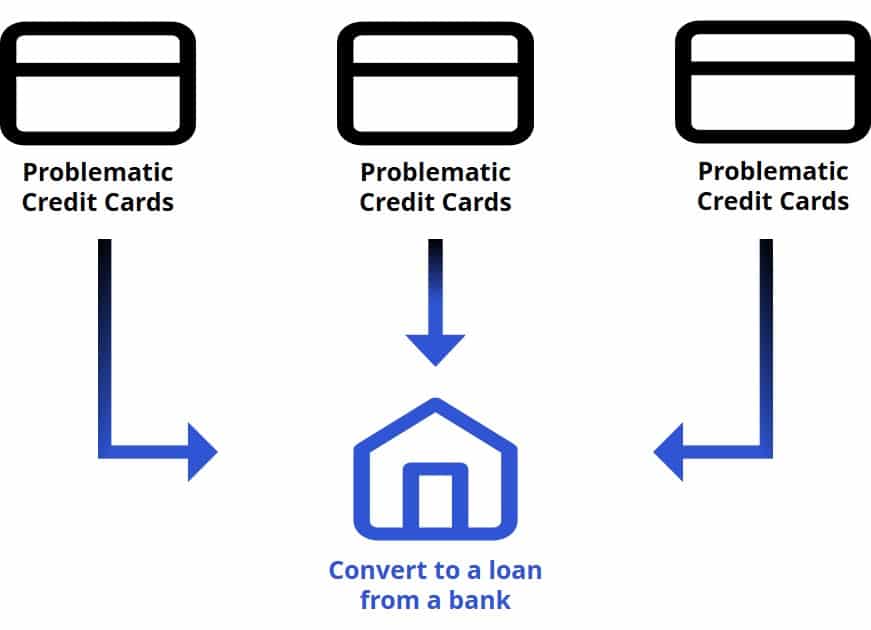

Just like transferring your balance to a new credit card, you can transfer your balance to a fixed loan.

Fixed means it’s amortized over a finite period of time. Usually credit cards provide a shorter period of time, resulting in higher monthly payments. This means more of that payment goes to the balance rather than interest and fees.

Home equity lines of credit (HELOC) are very powerful tools. In this market, rates are extremely low. If you’re trying to find out how to consolidate credit cards, consider a HELOC.

You can pay off the credit card with the HELOC with much more favorable terms.

Person to person (or “P2P”) lending sites have popped up. This is a new option that has not had time to mature. It is not necessarily recommended, but it is an option.

You could pay of your credit card debt with a loan from a P2P broker.

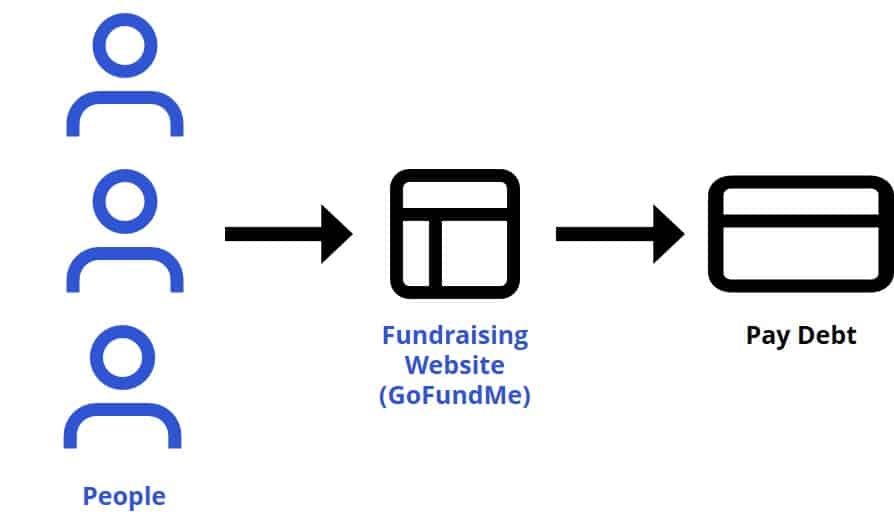

Better in some ways, worse in others: GoFundMe is a site that allows you to raise money by asking others to support a goal.

In terms of how to consolidate credit cards:

Church attendance in the United States is on the decline. There is a chance you’ve never heard of a benevolence request.

Some churches allow their members (or others) to ask the church for relief. This is usually for food or shelter or other lack of money.

You may present your benevolence request to your church and see if they would be willing to help you pay down your or pay off your credit card debt.

We tend to get stubborn and determined which might distract us from better options in certain circumstances. We focus so hard on “how to consolidate credit card debt” that we overlooking other options.

If worse comes to worst, you may want to consider options other than debt consolidation and paying down the debt. You may want to consider debt settlement.

Hiring a sufficiently skilled debt settlement company can help you negotiation and ultimately settle your credit card debt for less than you owe.

If all else fails and you have a tremendous amount of debt, bankruptcy may be an option.

People believe bankruptcy is the end of the world. That isn’t so. It could be appropriate. In fact, if you consider everything, you may find that the “down side” of bankruptcy outweighs the down side of your current debt situation.

Seek legal counsel to determine whether it’s right for you.

Covid-19 has changed how to consolidate credit card debt. Companies have created products. Banks have create programs. Governments have provided relief. For example:

There is many more. You just need to search for them.

First, debt is not insurmountable. It is fixable and solvable. Please remember:

We’re hopeful this article was timely and helpful.

We try to provide great articles. Help us share them.