-

Credit Repair Marketplace

-

Explore our extensive credit repair marketplace.

-

- Guaranteed Results

- Credit Insights

- For You?

The Telemarketing Sales Rule (TSR) imposes restrictions on certain businesses that sell products and services through outbound telemarketing and imposes severe restrictions on certain businesses that sell high-risk products and services through inbound and outbound telemarketing, credit repair being one of them.

Everyone has a characterization of a telemarketing operation: A smoke-filled, shyster-filled room operating to take advantage of the disadvantaged.

Everyone has their own interpretation of what telemarketing is: annoying, unsolicited, outbound cold calls in an attempt to provoke someone to buy an unwanted product or service.

Because of that, no one believes they’re a telemarketer and they believe even less that their inbound calls (when customers call you) trigger the TSR.

You should know that “telemarketing” has an extremely broad definition.

With a few narrow – and rarely applicable – exceptions and exemptions, telemarketing is defined as:

“…a plan, program, or campaign which is conducted to induce the purchase of goods or services or a charitable contribution, by use of one or more telephones and which involves more than one interstate telephone call.”

16 C.F.R. § 310.2(ff)

You should know:

And, to the entire purpose of this article, credit repair has special carve outs for inbound and out bound telemarketing.

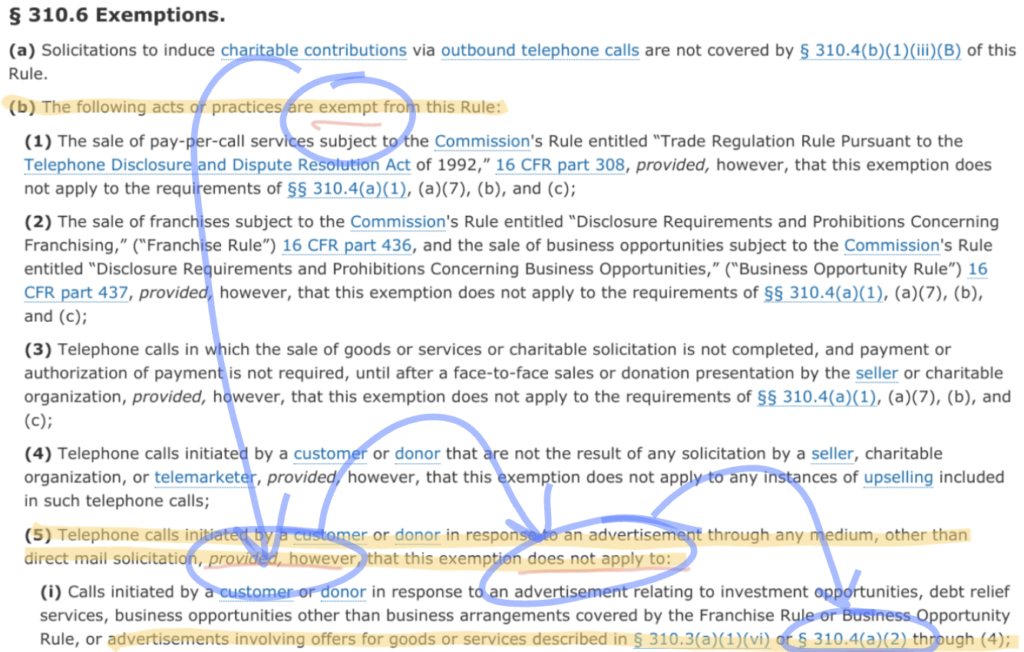

Before we get to the football-play-looking diagram, here’s basically what it says:

In other words, the TSR covers inbound and outbound calls if you’re selling credit repair products or services.

Just to be clear, that last citation in the football play – § 310.4(a)(2) – is credit repair (“…goods or services represented to remove derogatory information from, or improve, a person’s credit history, credit record, or credit rating…).

So, if you make an interstate call to a consumer and sell credit repair, the TSR applies.

Also, if you advertise for credit repair “through any medium,” and the consumer makes an interstate call to you and you sell credit repair, the TSR applies.

Or, as the National Consumer Law Center put it:

“The TSR also still applies to customer-initiated calls in response to advertisements relating to the following transactions: …Credit repair…”

https://library.nclc.org/fdl/050502-0

If you’re a credit repair company and the TSR applies to your transactions, then the TSR’s 6-month rule applies to your transactions.

If you’re unfamiliar with this provision, you should know that the TSR prohibits a credit repair company from taking payment from consumers until you provide a report dated 6-months after the services are complete which demonstrates that you fulfilled your obligations to your client.

Accordingly, this rule applies if you’re selling credit repair services through telemarketing, whether you make interstate calls to or receive interstate calls from consumers.

If you want to learn how to comply with this rule without disturbing your revenue model, please contact us.

We try to provide great articles. Help us share them.