-

Credit Repair Marketplace

-

Explore our extensive credit repair marketplace.

-

- Guaranteed Results

- Credit Insights

- For You?

For those credit repair companies interested in regulatory compliance, the Telemarketing Sales Rule (or “TSR”) has undoubtedly provoked a few questions.

The chief concern (and complaint) regarding TSR compliance is clearly it’s prohibition against prepayment.

Unlike the CROA, which prohibits the credit repair company from charging or receiving compensation prior to completing work, the TSR requires that a credit repair company complete it’s work, wait 6 months and then charge the consumer.

Credzu presented at CreditCon 2021 on the TSR as it relates to credit services.

As lawsuits pile up, this reality is becoming more and more popular within the industry.

But, that’s not technically the problem we’re going to address, here. There’s actually another layer on top of this problem.

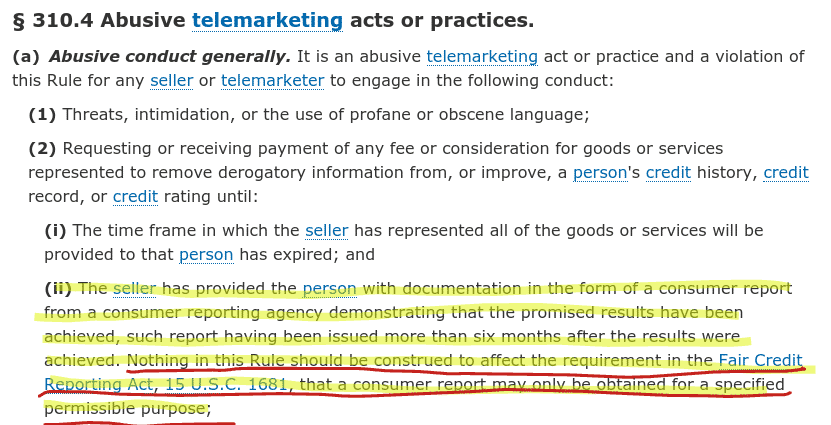

The relevant provision of the TSR imposes an additional requirement prior to getting paid: You must obtain a credit report proving you did what you said, such report having been issued more than 6 months after the work was performed.

This begs the question(s):

That last question is most important.

First, this is NOT legal advice. Take what you are about to read and ask your lawyer to consider it for you.

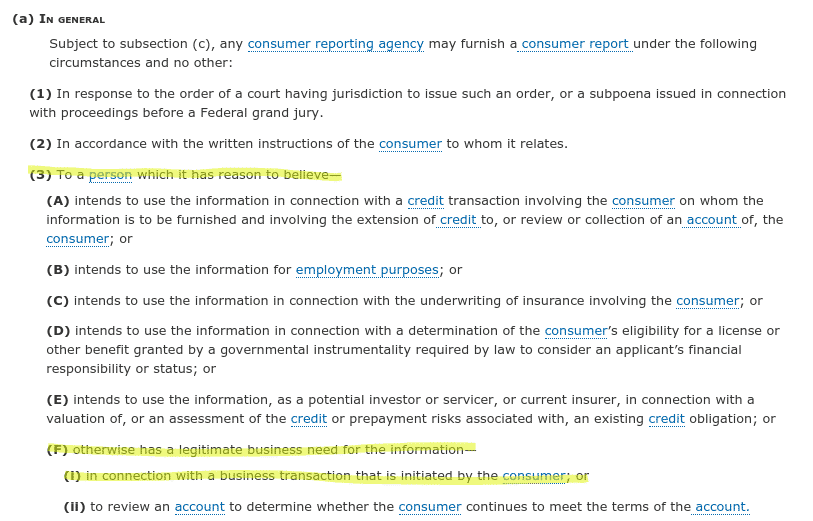

The Fair Credit Reporting Act describes those who have a permissible purpose to pull a credit report. If you do not have a permissible purpose and you do pull a credit report, that is a violation of the law.

So, is a credit repair company authorized to pull a credit report?

Possibly.

The question is whether a credit repair company has a permissible purpose to pull a credit report since they have a “legitimate business need” under the TSR’s provision that requires them to obtain one.

The answer clearly seems to be: yes.

The counterargument is that the TSR specifically says: “Nothing in this Rule should be construed to affect the requirement in the Fair Credit Reporting Act, 15 U.S.C. 1681, that a consumer report may only be obtained for a specified permissible purpose.” Does this mean the FTC promulgated a rule in such a way so as to require and prohibit the credit repair company from obtaining a report? Likely not.

It seems clear a credit repair company can obtain a credit report under the FCRA’s legitimate business need rule in order for the credit repair company to comply with the TSR’s provision concerning prepayment.

It’s certainly a valid concern.

Whether a client is maliciously avoiding you (a half-year later) or not, a stale relationship between two parties makes cooperation difficult.

One obvious solution to this problem is the use of a third-party escrow platform, like Credzu.

In this way, the money stays in escrow so that you’re not chasing down the consumer one twentieth of a decade after you did your job.

Get the report, deliver it to the consumer, and we release the funds to you.

It’s that simple.

We try to provide great articles. Help us share them.

How would one go about getting the report, however? What options would the CSO have to generate this (preferably at no cost to the CSO, if possible)?

I am unaware of ANY credit repair organizations that comply with the TSR (including the provision requiring the CRO to obtain a credit report and prove they did what they promised). So, hypothetically, how would the CRO get the report? There’s probably only one way since they do not have a permissible purpose under the FCRA: They’d have to ask the client (and hope the client provides it).